Business

NDIC Commences Payment of N16.18 Billion of bank liquidation dividends to Depositors

Following impressive recoveries from debtors and realisation of assets of banks in liquidation, the Nigeria Deposit Insurance Corporation (NDIC) has announced declaration of N16.18 billion liquidation dividends to depositors, creditors and shareholders of 20 banks in-liquidation. To this end, the Corporation has commenced verification and payment of stakeholders covered by…

Read More »Afreximbank signs land acquisition for African Trade Centre in Egypt’s New Administrative Capital

African Export-Import Bank (Afreximbank) has signed a formal agreement for the acquisition of land for the New Administrative Capital African Trade Centre (NAC-ATC), which will house the Bank’s headquarters, along with other trade-supporting facilities and entities, in Egypt’s new administrative capital in Cairo. The agreement provides for a complex that…

Read More »Seplat Energy’s gas revenue grows to $63.7 million year-on-year

Seplat Energy Plc, a leading Nigerian independent energy company listed on both the Nigerian Exchange Limited and the London Stock Exchange, has within a year experienced a 10.2 per cent gas revenue, reaching $63.7 million in 6M 2023 (compared to $57.8 million in 6M 2022). This growth is attributed to…

Read More »DMO offers 2 new FGN savings bonds for subscription

The Debt Management Office (DMO) on Monday announced an offer of two fresh Federal Government of Nigeria (FGN) Savings Bonds for subscription at N1,000 per unit. According to the DMO, the first offer is a two-year FGN savings bond due on Aug. 16, 2025, at interest rate of 9.634 per…

Read More »Danbatta Advises Businesses to Adjust with Disruptive Technologies

Executive Vice Chairman of the Nigerian Communications Commission, NCC, Prof Umar Garba Danbatta, has advised businesses to adjust to the potentials of disruptive technologies which have been adopted across the globe for enhanced productivity and sustainability. He told industry leaders and Information and Communication Technology (ICT) innovators, who gathered at…

Read More »CBN Cancels 2,698 Bureaux de Change Licences

The Central Bank of Nigeria (CBN) has reduced the number of Bureau de Change (BDCS) dealers to 2,991. The CBN on Wednesday published a list of approved BDCS in a document entitled: ‘Approved BDCs’. The document revealed that the licenses of 2,698 BDCs have been revoked. A similar list was…

Read More »CBN, CBE Set Up ‘Nigeria-Egypt FinTech Bridge’

The Central Bank of Nigeria (CBN) and the Central Bank of Egypt (CBE) have signed a memorandum of understanding (MOU) to establish a Nigeria-Egypt FinTech Bridge. The signing ceremony, which took place at the Seamless North Africa 2023 conference at the Egypt International Exhibition Center, Cairo, on July 17…

Read More »Access Bank launches Womenpreneur Pitch-a-ton Season 5

Retail giant Access Bank plc has unveiled the W initiative Womenprenuer Pitch-a-ton Season 5. The W Initiative is aimed at inspiring, connecting and empowering women while riding on the Access Bank’s vision to be the Bank of choice for women in the markets and communities being served. This is the…

Read More »CBN, Bill Gates To Collaborate On Financial Inclusion

The Central Bank of Nigeria (CBN) and the Bill and Melinda Gates Foundation (BMGF) have held strategic discussions in Abuja on how to deepen collaboration on financial inclusion in Nigeria. Speaking during the meeting on June 22, 2023, the Bank’s Acting Governor, Mr. Folashodun Shonubi, reiterated the commitment of the…

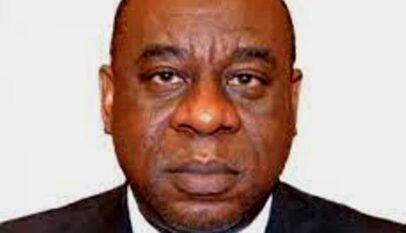

Read More »Folashodun Shonubi steps in as Acting CBN Governor

Following the suspension of the Central Bank of Nigeria (CBN) Governor, Mr Godwin Emefiele from office on Friday by President Bola Tinubu, the Deputy Governor (Operations Directorate), Mr. Folashodun Adebisi Shonubi has been directed to be the acting governor. About Shonubi Mr. Folashodun Adebisi was born on the 7th of…

Read More »