CBN, NCC order banks, telcos to settle N250bn USSD debt dispute

The Nigerian Communications Commission (NCC) and the Central Bank of Nigeria (CBN) have issued a joint directive to resolve the protracted N250 billion USSD debt dispute between Deposit Money Banks (DMB) and Mobile Network Operators (MNOs).

The directive, which mandates structured payment plans and debt settlements, aims to end years of contention over charges for USSD banking services.

The directive, titled “2nd Joint Circular of the Central Bank of Nigeria and the Nigerian Communications Commission on the Resolution of the USSD Debt Issue Between Deposit Money Banks and Mobile Network Operators” was cited on Monday.

This directive was akin to the recent report which I dictated that telecom operators was calling for a structured payment plan from regulators to address the mounting debt that has caused significant concern in both sectors.

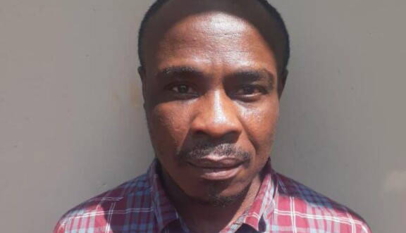

The circular dated December 20, 2024, signed by the Head of Legal and Regulatory Services at the NCC, Chizua Whyte and the Ag Director of the Payments System Management Department at the CBN, Oladimeji Taiwo, spelt out specific measures for debt settlement.

The joint statement expressed deep concern over the protracted dispute between DMBs and MNOs regarding the use of MNOs’ USSD platforms for banking services. Despite several efforts, the issue remains unresolved.

In response to this, the two regulators directed that 60 per cent of all pre-API invoices must be paid as full and final settlement.

DMBs and MNOs are required to agree on payment plans, either a lump sum or an installment, by January 2, 2025. If installment payments are chosen, they must be completed by July 2, 2025.

Meanwhile, post-API debts, which stem from transactions after the introduction of Application Programming Interfaces in February 2022, the CBN and NCC mandated that DMBs pay 85 per cent of all outstanding invoices by December 31, 2024. Additionally, 85 per cent of all future invoices must be cleared within one month of issuance.

The CBN and NCC also directed the immediate discontinuation of all litigation related to the USSD debt issue, adding that failure to comply with the directives would result in sanctions by the relevant regulatory bodies.

“In view of the foregoing, the CBN and the NCC hereby direct DMBs and MNOs as follows: 1. That 60 per cent of all pre-API invoices must be paid as full and final settlement. Payment plans (lump sum or installments) must be agreed upon between a concerned DMB and MNO by January 2, 2025. Installments must be based on equal monthly payments, with full payment due by July 2, 2025.

“DMBs must pay 85 per cent of all outstanding invoices issued after the implementation of APIs (i.e., February 2022) by December 31, 2024. Similarly, 85 per cent of future invoices must be liquidated within one month of service,” said the Circular.

The two organisations also emphasised that the transition to end-user billing will be activated only for DMBs and MNOs that comply with the payment terms.

Both agencies will provide further guidance on public enlightenment initiatives related to the transition.